INCOME FUND CA PATRIMÓNIO CRESCENTE

1

st

BIGGEST

FUND

in Portugal

17 Years in Operation

12

TIMES

WINNER MSCI

WINNER MSCI

3

TIMES WINNER

APPFIP

More than 22.000

Unit Holders

Unit Holders

% *

1 YEAR RETURN

€1.123M

Assets Under Management

December 31th, 2025

December 31th, 2025

SEVENTEEN YEARS OF ACTIVITY

THE BIGGEST REAL ESTATE INVESTMENT FUND IN PORTUGAL,

CAPC celebrates its 17th anniversary

CAPC celebrates its 17th anniversary

The Fund targets investors that are looking for an input in the real estate market supported by professional asset management. Results through consistent income and low volatility have been recognized all through the years both on a national and international level. The Fund was awarded for 12 times in a row with the MSCI prize and 3 times by APFIPP for the best open-ended real estate Fund.

UNIT VALUE 2026-02-27

24,1457 €

-

Fund Type

Open-Ended Real Estate Investment

Fund - Inception Date 15-07-2005

| Fund Name | CA Património Crescente |

| Minimum Recommended Investment Period |

3 Years |

| Currency | Euro (€) |

| ISIN | PTSQUBHM0002 |

| Manager | Square Asset Management, Sociedade Gestora de Organismos de Investimento Coletivo, S.A. |

| Distributor | Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking |

| Custodian | Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L |

For more information, Prospectus, Key Information for Investors, Management Regulation, Reports and Accounts,

please contact Square Asset Management, Sociedade Gestora de Organismos de Investimento Coletivo, S.A., Depositary Bank and CMVM’s web site.

please contact Square Asset Management, Sociedade Gestora de Organismos de Investimento Coletivo, S.A., Depositary Bank and CMVM’s web site.

(*) The value of the participation units held will vary according to the evolution of the value of the assets that constitute the fund. Investment in the Fund may result in the loss of the invested capital.

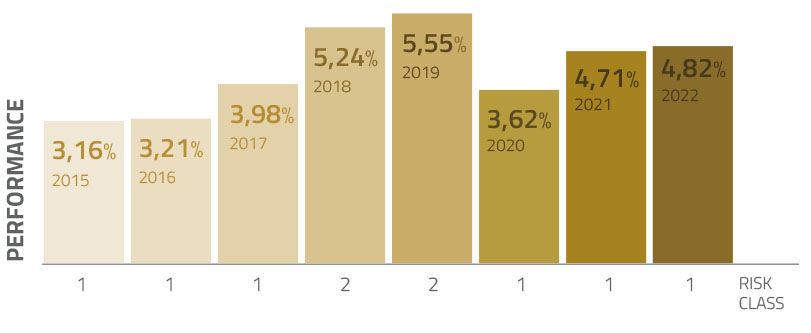

The information here provided should be complemented by reading the prospectus, Key Information, and all relevant e legal information of the fund that is available on this site, www.cmvm.pt, distributors (Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking) and Depositary Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L) . All performances disclosed represent past data and do not constitute a guarantee of future ones because the value of the units may increase or decrease. The risk level varies between 1 (low risk) and 7 (very high risk). Performances disclosed here are annualized, net of tax in the Fund, management fees and depositary; are not net of subscription and redemption fees and should be consulted in the fund's legal documents. With regard to the applicable tax regime, it should be analyzed of: i) the taxation of income obtained by the assets held by the fund; ii) the participant's tax framework. The applicable tax regime, for the fund and participant, is provided in the prospectus of the fund. The returns presented that refer to periods greater than one year would only be obtained if the investment were made during the whole reference period.

Redemption Fees:

Between 365 and 1094 days: 1%;

More than 1095 days: 0%

Asset Manager: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A

The information here provided should be complemented by reading the prospectus, Key Information, and all relevant e legal information of the fund that is available on this site, www.cmvm.pt, distributors (Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking) and Depositary Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L) . All performances disclosed represent past data and do not constitute a guarantee of future ones because the value of the units may increase or decrease. The risk level varies between 1 (low risk) and 7 (very high risk). Performances disclosed here are annualized, net of tax in the Fund, management fees and depositary; are not net of subscription and redemption fees and should be consulted in the fund's legal documents. With regard to the applicable tax regime, it should be analyzed of: i) the taxation of income obtained by the assets held by the fund; ii) the participant's tax framework. The applicable tax regime, for the fund and participant, is provided in the prospectus of the fund. The returns presented that refer to periods greater than one year would only be obtained if the investment were made during the whole reference period.

Redemption Fees:

Between 365 and 1094 days: 1%;

More than 1095 days: 0%

Asset Manager: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A

| Minimum Subscription Amount | 25 Units (about € 604) |

| Following Subscriptions | No Minimum |

| Subscription Fee | 0% |

| Redemption Fee | Between 365 and 1094 days: 1%; More than 1095 days: 0% For more information see prospectus |

| Management Fee | 1% per year |

| Custodian Fee | 0,25% per year |

| Performance Fee | 10% of the difference between 12-month Euribor rate plus 2% and the fund performance. |

The Prospectus, Key Information for Investors and Management Regulations are available at the places and means of commercialization and at www.cmvm.pt.

(*) The value of the participation units held will vary according to the evolution of the value of the assets that constitute the fund. Investment in the Fund may result in the loss of the invested capital.

The information here provided should be complemented by reading the prospectus, Key Information, and all relevant e legal information of the fund that is available on this site, www.cmvm.pt, distributors (Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking) and Depositary Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L) . All performances disclosed represent past data and do not constitute a guarantee of future ones because the value of the units may increase or decrease. The risk level varies between 1 (low risk) and 7 (very high risk). Performances disclosed here are annualized, net of tax in the Fund, management fees and depositary; are not net of subscription and redemption fees and should be consulted in the fund's legal documents. With regard to the applicable tax regime, it should be analyzed of: i) the taxation of income obtained by the assets held by the fund; ii) the participant's tax framework. The applicable tax regime, for the fund and participant, is provided in the prospectus of the fund. The returns presented that refer to periods greater than one year would only be obtained if the investment were made during the whole reference period.

Redemption Fees:

Between 365 and 1094 days: 1%;

More than 1095 days: 0%

Asset Manager: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A

(*) The value of the participation units held will vary according to the evolution of the value of the assets that constitute the fund. Investment in the Fund may result in the loss of the invested capital.

The information here provided should be complemented by reading the prospectus, Key Information, and all relevant e legal information of the fund that is available on this site, www.cmvm.pt, distributors (Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking) and Depositary Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L) . All performances disclosed represent past data and do not constitute a guarantee of future ones because the value of the units may increase or decrease. The risk level varies between 1 (low risk) and 7 (very high risk). Performances disclosed here are annualized, net of tax in the Fund, management fees and depositary; are not net of subscription and redemption fees and should be consulted in the fund's legal documents. With regard to the applicable tax regime, it should be analyzed of: i) the taxation of income obtained by the assets held by the fund; ii) the participant's tax framework. The applicable tax regime, for the fund and participant, is provided in the prospectus of the fund. The returns presented that refer to periods greater than one year would only be obtained if the investment were made during the whole reference period.

Redemption Fees:

Between 365 and 1094 days: 1%;

More than 1095 days: 0%

Asset Manager: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A

Evolution of Unit Value

Value

(*) The value of the participation units held will vary according to the evolution of the value of the assets that constitute the fund. Investment in the Fund may result in the loss of the invested capital.

The information here provided should be complemented by reading the prospectus, Key Information, and all relevant e legal information of the fund that is available on this site, www.cmvm.pt, distributors (Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking) and Depositary Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L) . All performances disclosed represent past data and do not constitute a guarantee of future ones because the value of the units may increase or decrease. The risk level varies between 1 (low risk) and 7 (very high risk). Performances disclosed here are annualized, net of tax in the Fund, management fees and depositary; are not net of subscription and redemption fees and should be consulted in the fund's legal documents. With regard to the applicable tax regime, it should be analyzed of: i) the taxation of income obtained by the assets held by the fund; ii) the participant's tax framework. The applicable tax regime, for the fund and participant, is provided in the prospectus of the fund. The returns presented that refer to periods greater than one year would only be obtained if the investment were made during the whole reference period.

Redemption Fees:

Between 365 and 1094 days: 1%;

More than 1095 days: 0%

Asset Manager: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A

The information here provided should be complemented by reading the prospectus, Key Information, and all relevant e legal information of the fund that is available on this site, www.cmvm.pt, distributors (Caixa Central de Crédito Agrícola Mútuo through banking network, branches, and internet banking) and Depositary Bank (Caixa Central — Caixa Central de Crédito Agrícola Mútuo, C.R.L) . All performances disclosed represent past data and do not constitute a guarantee of future ones because the value of the units may increase or decrease. The risk level varies between 1 (low risk) and 7 (very high risk). Performances disclosed here are annualized, net of tax in the Fund, management fees and depositary; are not net of subscription and redemption fees and should be consulted in the fund's legal documents. With regard to the applicable tax regime, it should be analyzed of: i) the taxation of income obtained by the assets held by the fund; ii) the participant's tax framework. The applicable tax regime, for the fund and participant, is provided in the prospectus of the fund. The returns presented that refer to periods greater than one year would only be obtained if the investment were made during the whole reference period.

Redemption Fees:

Between 365 and 1094 days: 1%;

More than 1095 days: 0%

Asset Manager: Square Asset Management - Sociedade Gestora de Organismos de Investimento Coletivo, S.A